Accepting Higher Structural Inflation: The Fed Will Cut!

Analysing the arguments both against and in favour of the Fed cutting interest rates, how the other central banks will follow, and where this leaves inflation in the longer-term.

The Federal Reserve stands at a critical juncture. After an aggressive campaign of interest rate hikes to combat soaring inflation, the U.S. central bank is now facing a more complex economic climate. Most advisors and fund managers have accepted that we are in the midst of a recession, even if the American and European governments don’t acknowledge it officially. The question must now turn to whether the U.S. and global economies will face a soft or hard landing. Part of this is unwinding the rate hikes done over the last couple of years, but how fast and when is a critical sub-question the Federal Reserve and central banks across the world must answer. Today we will tackle this question head-on, and deal with the popular arguments for why the Fed will cut already heavily priced into the markets and the outlier argument against it.

The last time the Federal Reserve cut rates was back in 2020, in response to the economic shutdown caused by lockdown mandates to control the spread of the COVID-19 pandemic. This cut saw rates drop rapidly in March 2020 in an attempt to control asset price crashes on the stock exchanges and to encourage borrowing to lift the economy back to its feet after it was knocked to the ground by lockdowns. Arguably this monetary policy was successful and we saw quick rebounds in asset prices. However, the real economy lay stagnant for much longer and was then hit with the following inflation caused by the low rates and fiscal stimulus.

In 2021, U.S. Treasury Secretary, Janet Yellen informed the public and international finance community that such inflation was transitory. It was not. Inflation continues to this day. Officially, CPI (the Fed’s preferred measure) stood at 2.9% in July 2024, only 90 basis points off the 2% target.

Inflation is not a single number. Real inflation is a basket of goods. It will vary from person to person. This isn’t reflected in the Consumer Price Index, that basket is changed year-to-year and in more recent times has put more and more weight on technology (which has trended down in price), thereby putting less weight on the essentials. For example, in 2023, spirit-based drinks were removed entirely from the basket. I don’t live in the U.S. but on that infamously rainy island just north of the European continent, however removing spirit-based drinks means that CPI in the U.S. no longer reflects my personal life nor that of my friends. My basket is far different from the teetotaller.

We will use Diego Parrilla’s (Investment Manager at Quadriga Asset Management) rule of thumb: real inflation is double official inflation.

This is why the Biden Administration, the media, and academics created the new term “Vibeflation.” Dismissing the concerns of the average Joe around the real and personal inflation they were experiencing because official inflation is both down and near target - when for many baskets it was arguably continually increasing around the world until recently.

No matter your personal basket, a rate cut will have the same effects in financial markets: increased inflationary pressures, increased asset prices (potentially to bubble levels but that is a separate topic), and increased debt and liquidity levels - all stemming from the lower borrowing costs.

But with elections coming up and CPI still 90 basis points off target, will the Fed cut?

A Tight Grip Loosening: The Fed Will Cut!

This is what the markets have already priced in. The Federal Reserve will cut rates in September. Here’s why:

The Real Gamble

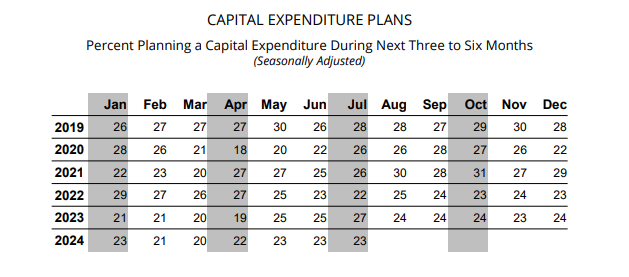

NFIB Small Business Optimism Index rose 2.2 points in July to 93.7, the highest reading since February 2022. However, both capital expansion and employment are still very weak. That is small businesses are getting more confident but that’s not being reflected in terms of additional business expansion through hiring more labour or purchasing more capital goods. According the the most recent NFIB survey only 23% (seasonally adjusted) of small businesses plan capital outlays in the next six months, unchanged for the third consecutive month. This represents actual investment in the real economy.

The Fed is trying to get a soft landing. Such a landing will be indicated if investment in the real economy increases. That is if there is more hiring and more capital expenditure by small businesses. A rate cut should help increase both. If it doesn’t then a hard landing is likely inevitable anyway.

So, either the Fed cuts rates and we see a soft landing, or they cut rates and see a hard landing, or they don’t cut rates and get a hard landing from overtightening but with low inflation. With inflation at 2.9% officially, it’s hard to see why they wouldn’t take the gamble in the real economy. Other central banks have already cut their rates, including the ECB and BoE. It’s hard to see why the Fed wouldn’t follow.

The Bear Hug

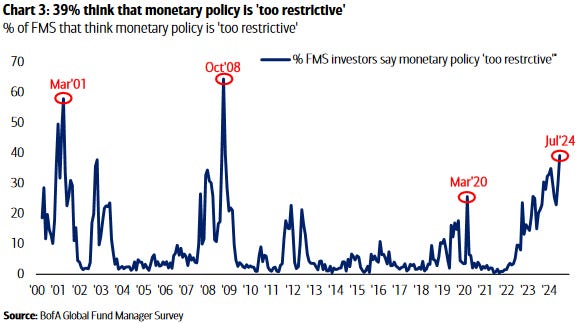

Rates are already too restrictive. When rates are restrictive something eventually breaks.

"Monetary policy is too restrictive according to 39% of investors, the most restrictive since November 2008, but this in turn deepens the belief that global interest rates are set to fall over the next 12 months.”

-Bank of America Global Fund Manager Survey

We might have already seen the breakage of this cycle in the yen carry trade unwind a couple of weeks ago. The Bank of Japan unexpectedly raised its interest rates. Consequently, investors who had borrowed yen at low rates to invest in higher-yielding assets rushed to unwind their positions to avoid losses. The sudden shift in market sentiment amplified the impact of the unwind, leading to significant volatility.

When something breaks the central banks have to respond, in this case with a cutting cycle. This market earthquake is already (mostly) over, but it is likely another such event will occur if the Fed continues with monetary tightening. Especially so as other central banks begin to cut their rates (more opportunities for carry trades that can reverberate around the system when they need to be unwound).

The U.S. Government Won’t Stop F*@!king Spending

The Fed is independent. That doesn’t stop government spending from playing into key interest rate decisions. The federal funds rate is the benchmark for Treasury bills and other short-term securities. As the fund rates rise the cost of borrowing for the government does too. Currently, government debt stands at 122% of U.S. GDP. This too big a percentage of GDP (it’s going this way for most countries). That’s not to say the government will default but that the federal budget is going to become more and more restrictive as the cost of paying that debt rises. The cost of interest on that debt is right now about $2.4 billion per day, on average. That will rise to $4.7 billion per day in 2034 according to the Congression Budget Office projections. That’s with a projected annual average interest rate 3.5%. The federal funds rate needs to come down to make this debt manageable.

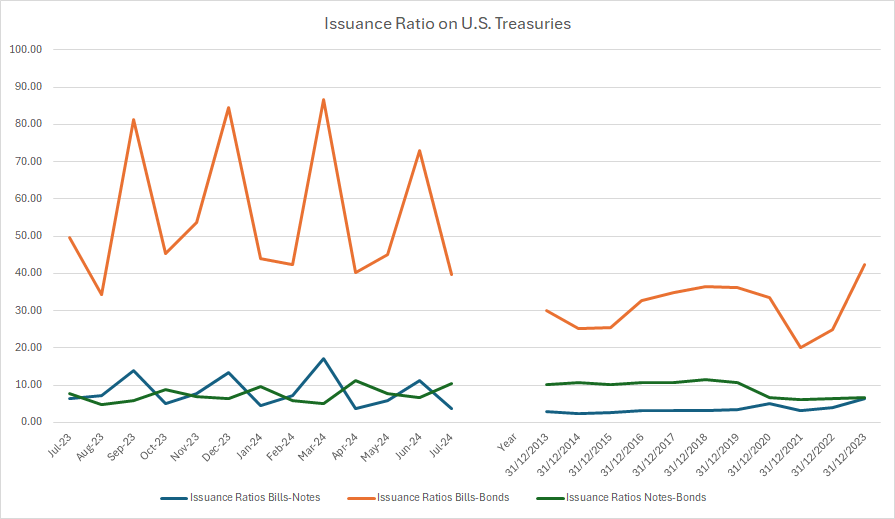

Yellen is supposed to be financing debt in the long term, in 20-30 year maturities. But what we see is a huge increase in shorter-term bills (3 months to 1 year) relative to the bonds.

By doing this Yellen is essentially forcing the hand of the Fed to cut rates and not lock in higher interest rates in the long term. I’ll recommend this Thread from GoldFix for further reading on the topic.

These arguments are very strong, and show why the markets have so heavily priced in not only a near-term cutting cycle but a big one at that, with an expected start date in September.

However, we always need to look at the counterargument, the outlier scenario.

Tightening on the Tightrope

The Fed is the last to know. Time and time again it has been said that the Federal Reserve mistimes its loosening and its tightening, often only doing so once damage has been done. So what are the arguments for the Fed not cutting and continuing to hold onto the economy’s neck?

Inflation Uncertainty and Expectations

The Federal Reserve Bank of New York’s Center for Microeconomic Data today released the July 2024 Survey of Consumer Expectations, which shows that inflation expectations were stable at the short 1-year horizon and the longer 5-year horizon. However, inflation expectations did fall sharply at the medium-term 3-year horizon. Median inflation uncertainty—or the uncertainty expressed regarding future inflation outcomes—was unchanged at all three horizons.

The Fed hasn’t completed its task of managing inflation expectations then. This goes back to what we talked about earlier: everyone has a personal basket that is very much disconnected from the CPI measure that the Fed publishes. The view among many Americans is that inflation is still high among certain goods.

Geopolitical Uncertainty

What do geopolitics, foreign policy, and security have to do with inflation? International transportation.

Global freight rates are interconnected. If the situation in the Red Sea or the Middle East continues to decline then the shipping rates from say Shanghai to Rotterdam are going to increase, as the route becomes riskier to transit or longer (having to go around South Africa). If shipping rates on that route increase, as a shipping company you reallocate resources to that route. Taking away capacity from say Shanghai to Los Angeles. This in turn increases the shipping rates on that route.

These rate increases will be passed (or at least a percentage will) onto the consumer goods coming that route.

To add to this problem even more, a lot of our modern warehousing, freight, and retail systems rely on just-in-time delivery. Companies don’t want to take the risk of goods not getting to consumers on time and consumers (especially in the West) don’t want to wait for said goods. This leaves many international shipping companies to turn to air freight, which is more expensive and will, once again, pass on costs to consumers.

This all adds up to inflation through international markets, the Fed will need to take into its estimations on whether or not to cut.

November Drama and Impartiality

The U.S. Election will take place on the 5th of November this year. The Fed can’t be seen to be giving economic boosts to incumbent candidates - which is what Kamala is, having been VP in the Biden Administration. Donald Trump has already attacked the Fed’s independence because of Powell. Several banks have recently delved into claims by Trump that if he's elected he would not reappoint Jerome Powell on the expiry of the Fed chair's term in 2026.

Powell and the rest of the board don’t want to give any political ammunition to Trump that would allow him to do that. By cutting rates in the build-up to the election the Fed opens themselves up to accusations of partiality.

The arguments for a cut, clearly outweigh the arguments against one. However, it’s always important to analyse the counterargument and consider it a possibility. Have the markets over-priced the probability of a cut?

Structurally Higher Inflation

GDP growth has been strong but government spending has increased markedly, something which does not typically happen.

At present, central banks are mandated in the US, Eurozone, and UK to achieve inflation at or near 2%. This will likely shift higher as cuts come to either a higher percentage or a nominal GDP target. Even if they don’t announce such a policy, it’ll be evident in the reported inflation rates over the next few years.

The global economic situation is fragile because of excessive debt and abuse of monitoring fiscal policies, especially after 2008. The world, and not just the U.S. is going to need more printing and more debt. More liquidity will be needed to sustain the system and more debt will demanded to fund political programs and economic recovery. This will lead to higher structural inflation over the next decade.

“So structurally, if we think about emerging markets as perhaps the leader of what's to come, very often, we used to, I hear and people talk about the Japanification of the world, or the Argentinification of the world. My view is, you're seeing the Argentinification of Japan. And we've seen that with the UK. I mean, theoretically, developed markets behaving like wild emerging markets and emerging markets being, having learned from their lessons.

So I think when it comes down to inflation, again, both camps can be correct. Don't let the short-term dynamics fool you. The world's going to need significantly more printing and more debt. Things like yield curve control that we pretend that we can live without, in my view, they're coming back[…]”

-Diego Parrilla on Macro Voices Podcast

(Investment Manager @ Quadriga Asset Management)